Renters insurance is one of those things you hopefully never have to use. But when the unexpected happens, it can be a lifesaver to have. If your belongings get stolen, damaged, or destroyed, your renters insurance policy is there to help you recover. But what happens when it’s time to file an insurance claim?

The process may bring up a ton of questions. What if your claim gets denied? How long will it take? Will your insurance rate go up if you file a claim?

If any of these uncertainties sound familiar, you’ve come to the right place. In this article, we will break the renters insurance claims process down step by step, with a few simple tips to help get your payout without the headache.

When should you file a renters insurance claim?

You’d file a renters insurance claim when something goes wrong and it’s something your policy covers. Here are some of the most common situations where renters typically file a claim:

- Theft: If someone breaks into your apartment and steals your laptop, TV, or other valuables, your policy likely covers it.

- Fire or smoke damage: Even a small kitchen fire can cause costly deterioration to your belongings.

- Personal liability: If a visitor gets injured in your home and sues you, your policy could cover legal and medical costs.

- Water damage: If a pipe bursts or a neighbor’s overflowing tub floods your apartment and ruins your furniture, you may be covered. However, flooding may require separate coverage for certain “natural” events like rainstorms, so check the fine print before filing a claim.

Are you unsure if your situation qualifies? Check your policy to understand the covered losses (or “named perils”) or call your renters insurance provider to get help.

Common questions about renters insurance claims

1. “What if my claim gets denied?”

Everyone wants to avoid having their renters insurance claim rejected. Here’s why claims usually get denied and how to prevent it:

❌ Reason: The damage isn’t covered.

✔ Solution: Not everything is covered, so review your policy to know what’s excluded. For example, renters insurance typically covers water damage from a broken pipe but not from flooding from a storm.

❌ Reason: You don’t have enough proof.

✔ Solution: Take photos, keep receipts, and make an inventory of your belongings. If something breaks or gets damaged, you’ll have documentation to support your claim.

❌ Reason: You waited too long to file.

✔ Solution: Most insurers have a time limit for filing claims. Know your provider’s requirements and act quickly after an incident.

2. “Is filing a claim complicated?”

The short answer is no — filing a renters insurance claim doesn’t have to be complicated. If you’re prepared, the process can go smoothly, and you could be reimbursed in a few days to a few weeks. Just make sure you provide proper proof of damage, document everything clearly, and maintain regular contact with your insurer.

3. “Will my insurance rate go up if I file a claim?”

Rate changes depend on your insurance company, but many providers don’t consider filing renters insurance claims a reason to increase your premiums.

For example, with ResidentShield Insurance, your premium rates won’t increase if you file a claim.

The 3-step formula for filing a renters insurance claim

Filing a renters insurance claim is easy if you know what to do. These three simple steps break it down:

Step 1: Gather your evidence immediately

The more proof you have, the smoother your renters insurance claims process will be. Here are a few things you need to organize:

- Take photos and videos: Be sure to capture the incident from multiple angles.

- List missing or damaged items: Keep an updated inventory of your belongings to easily include estimated costs and purchase dates.

- Find receipts or bank statements: Proof of ownership of lost items can speed up the process.

- File a police report (if needed): Most insurers will require a report if your claim involves theft, vandalism, or burglary. Call the police as soon as the incident occurs.

Step 2: Submit your claim the right way

Most insurance companies allow you to file renters insurance claims online through a mobile app or by calling the claims team. Have the following information ready:

- Your policy number

- A description of what happened

- The date and time of the incident

- A copy of the police report (if needed)

- Your list of damaged or stolen items

Some insurers may send additional forms, so make sure to fill them out quickly to avoid delays.

Step 3: Follow up and get your payout

After submitting your claim, here’s what typically happens:

- An adjuster may inspect the damage: For larger claims, the insurer may send someone to assess the situation. Be prepared to answer additional questions.

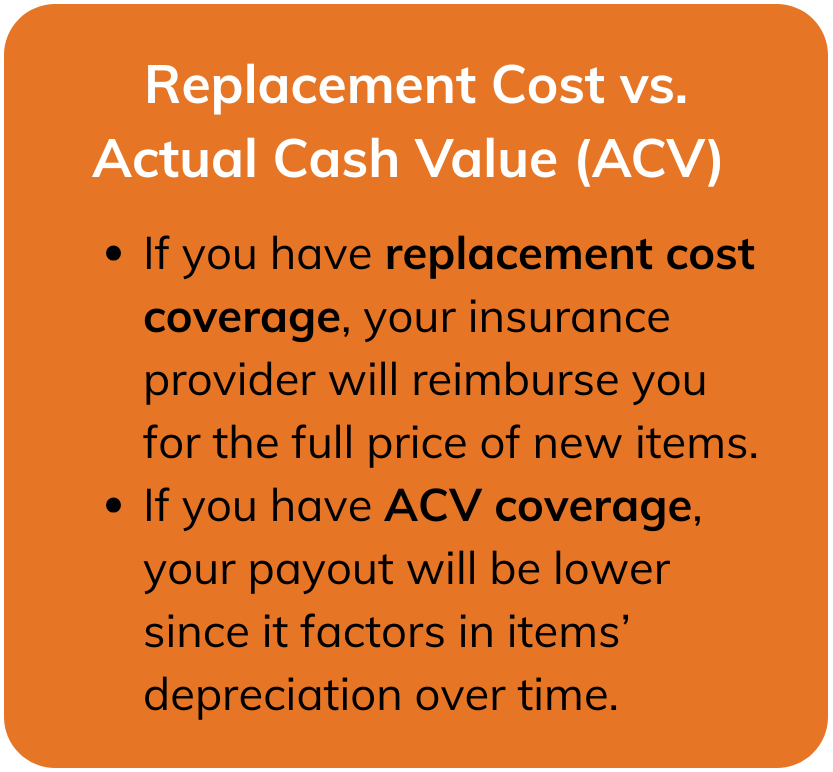

- You receive your payout: Once your claim is approved, you’ll get a check or direct deposit.

Every once and a while, we stumble into situations we didn’t plan for. That’s why understanding renters insurance claims can make a stressful situation a lot easier to handle. The key is being prepared: understand what your policy covers, keep a record of your belongings, and act quickly when something goes wrong. Filing a claim isn’t as complicated as it sounds and could save you thousands.

Now’s a great time to review your renters insurance contract, and if you don’t have coverage yet, consider getting a policy. It’s an affordable way to protect your home, your valuables, and, ultimately, yourself.