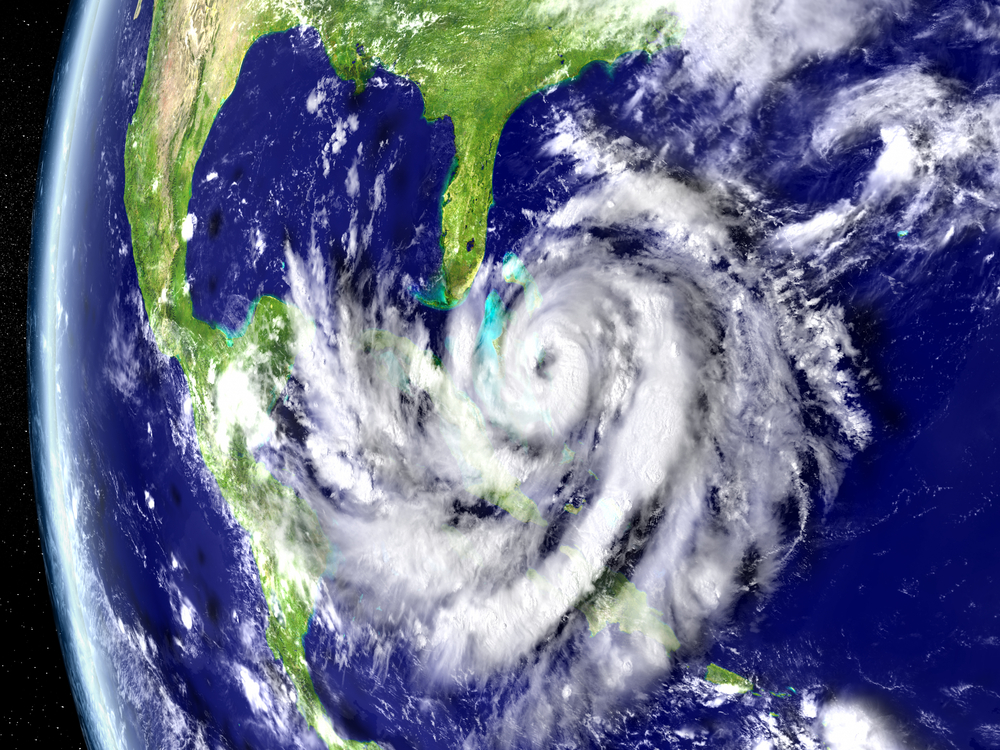

Hurricane Matthew leaves behind a trail of destruction. Even though reports show that the mega-storm has decreased to a category 3 hurricane, the danger has not passed. So far, over 2 million people in Florida, South Carolina and Georgia have been told to evacuate, the largest since hurricane Sandy h it the east coast in 2012. Moreover, the Weather Channel reports that Matthew is set to become the strongest tropical storm to slam into the east coast in Florida since Andrew pummeled the area in 1992. The millions of people who remain in the storm’s path should prepare now.

it the east coast in 2012. Moreover, the Weather Channel reports that Matthew is set to become the strongest tropical storm to slam into the east coast in Florida since Andrew pummeled the area in 1992. The millions of people who remain in the storm’s path should prepare now.

- Review and practice your evacuation plan—know where to go and what to take with you if you must leave your home. If you have children, pets, elderly relatives or someone with special needs you need to be twice as attentive. Review your preparation checklists and stay up to date with information about local evacuation routes and other details about the disaster.

- Make necessary preparations for flooding—first, find out if your county is offering sandbags. You probably already knnew this—standard homeowners insurance policies do NOT cover flood damage, but adquate coverage can be purchased from FEMA’s National Flood Insurance Program and also from some private insurers. If possible, move your car to higher ground—it’s good to know that flood damage to vehicles is covered under the optional comprehensive portion of the auto insurance policy.

- Hurricane-proof your home—as long as time (and the weather) permits it, install shutters or plywood to protect doors and windows from the high winds and flying debris.

- Know your hurricane deductible—typically, homeowners insurance policies include a special deductible that applies when the cause of damage is a hurricane. On the policy’s declarations page is listed the exact dollar amount of the deductible; it’s important to understand how this will affect your claim.

- Have your insurer’s phone number handy—if your home is damaged by the storm, announce your insurance company as soon as possible. The contact information for your insurance agent or company should be handy in the event you need to file a claim. As important is to notify your insurer how to reach you in case you need to evacuate.

- Home inventory—mishaps can occur even in the happiest of times, so it’s advised that you keep an updated home inventory as it can speed up the claims filling process, while also substantiating losses for income tax purposes.